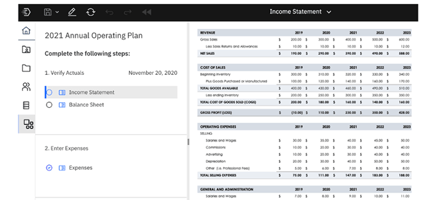

The latest release of IBM Planning Analytics Workspace (Release SC57) offers an avalanche of new...

Managing the Impact of Tariffs On Product Profitability in Retail with IBM Planning Analytics

This case study is based on one of our large online clothing retail customers. The company carries over 200,000 active products (SKUs) across over 2,000 brands at any point in time. The products can be sourced from 200 countries, approximately 50 countries have open purchase orders at any time. All products are sold globally through a network of fulfillment centers.

The customer is using IBM Planning Analytics for their financial performance management – specifically actuals reporting, financial planning and forecasting but also demand planning, profitability management, stock replenishment and inventory optimization. The application manages products at the SKU level with over 1 million elements in the product dimension (200,00 active SKUs plus over 800,000 with sales history for modeling and analytics purposes). IBM PA also supports sales forecasting at the product level. It applies statistical methods to time series of data and incorporates other factors and variables such as discounts and rebates, promotions, bundles and other. The results are automatically integrated into the company's financials.

The introduction of tariffs is affecting the product and business profitability in two key ways:

Increased Cost: Each country of origin has a different tariff structure. Furthermore, individual items from each product can be sourced from multiple countries depending on brand, style and color. The impact of tariffs on different categories or product types vary. The ability to understand the impact of tariffs on individual items based on current supply chain structure is critical to maintain profitability while minimizing impact on customers and thus sales. Measures may include absorbing tariffs on some products, passing all or portion of tariffs to the customer, adjusting the supply chain and moving production to lower-tariff countries etc.

Tariff Policy Stability: Not only do the tariffs add cost to the supply chain, they seem to change change at a very rapid pace. This makes it difficult to make strategic decisions about pricing and long term supply chain adjustments. An effective scenario planning and what-if analysis is required to model various scenarios and evaluate the cost / benefit from a short as well as long term perspective and make effective decisions and maintain flexibility to the extent possible.

Our solution

To address these acute challenges, we worked with the customer to include capabilities in the existing IBM Planning Analytics application that provide greater transparency of profit margins and help effectively manage various scenarios.

As a short-term measure, we focused on open purchase orders and included the following capabilities:

- Included a tariff measure to identify tariff cost by source country based on individual product attributes

- Calculated tariff impact on product profitability in real time

- Enabled scenario planning to shift sourcing of specific items to lower-tariff zones where possible and show the cost of that change offset by lower tariff impact

- Incorporated the new scenarios into cash forecasting to measure the effect of various decisions on liquidity and cash flow.

- Crated a dynamic input for tariff updates and scenarios that can be used in negotiations with vendors based on real time tariff updates.

Since this was an existing application with the core structures in place, these capabilities were introduced in less than 1 week. This demonstrates the efficiency of model design and its ability to flex to new requirements, but also the modeling flexibility of IBM Planning Analytics. We are now in the process of further expanding this capability and addressing more long-term strategies for structural and supply chain adjustments.