Insurance Risk and Capital Management

Automate and Streamline Calculation of Risk Capital and P&L across all Risk Categories

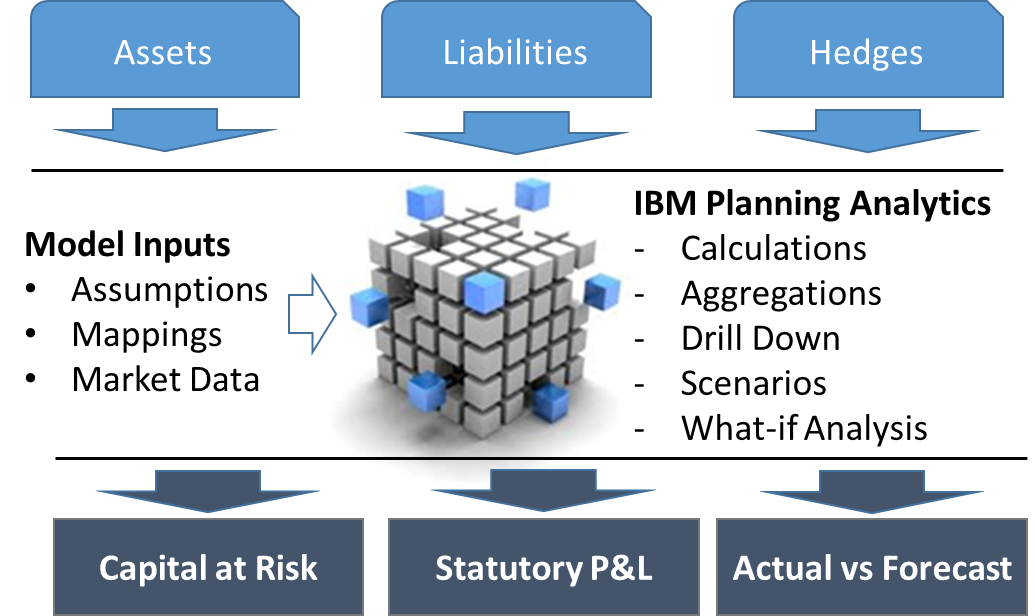

The ACG Insurance Risk Capital model automates the calculation of Stress Capital under various stress assumptions for all core categories of risk. It automates the calculation and aggregation of risk and associated P&L while improving transparency of the process and providing greater flexibility, analytical and reporting capabilities

Risk Model Components:

| Product Level Inputs | Capital and Risk Assumptions | Model Outputs |

|

|

|

Core Risk Model Characteristics:

- Product Level Detail by major block of business

- Sensitivity analysis on rates and other assumptions

- Investment portfolio capital impact from changes of asset composition or rating agency actions

- Impact of hedging strategies and re-insurance contracts on Legal Entities

- Monthly or quarterly run of risk, daily rates updates

- Risk under different reporting standards / regimes

- Intuitive reporting and visualization with drill down to detail

Business Benefits:

- Greater model transparency for input, assumptions and calculations

- Improved controls resulting in lower risk of errors

- Greater flexibility in managing risk and measuring impact of actions and changes in assumptions